ETH Price Prediction: Will Ethereum Surge to $4,000 Amid Bullish Momentum?

#ETH

- Technical Outlook: ETH must reclaim its 20-day MA ($3,774) to confirm bullish trend

- Institutional Catalyst: $600M+ ETH acquisitions by Bit Digital/ARK Invest signal long-term confidence

- Market Sentiment: Santiment data shows whale accumulation during dips, a historically bullish signal

ETH Price Prediction

ETH Technical Analysis: Key Indicators to Watch

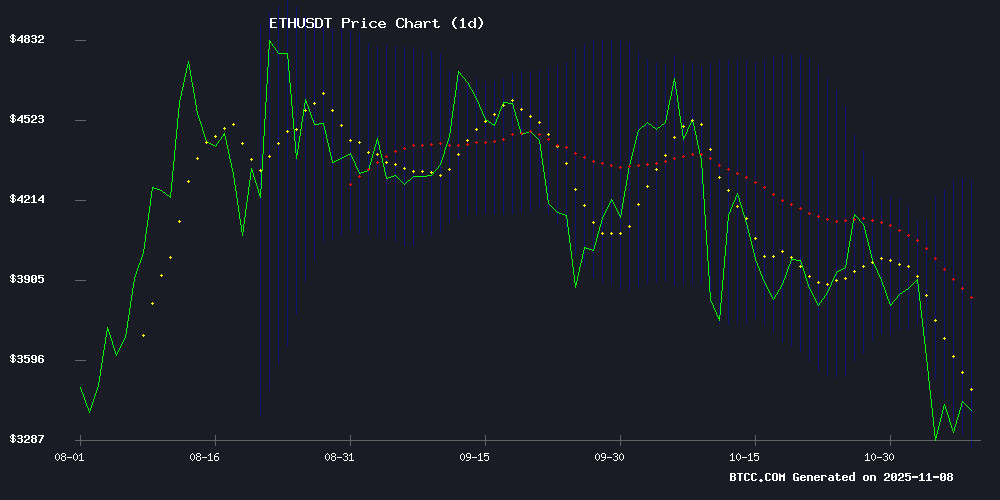

According to BTCC financial analyst John, Ethereum's current price of $3,433.32 is below its 20-day moving average (MA) of $3,774.86, suggesting short-term bearish pressure. However, the MACD indicator shows bullish momentum with a reading of 170.57 above the signal line. Bollinger Bands indicate potential volatility, with the price hovering NEAR the lower band at $3,263.48. A breakout above the middle band ($3,774.86) could signal a bullish reversal.

Ethereum Market Sentiment: Institutional Demand Fuels Rally

BTCC analyst John highlights strong institutional interest in Ethereum, as seen with Bit Digital's $590.5M ETH accumulation and ARK Invest's $9M BitMine purchase. Market sentiment is bullish, with whales accumulating during dips and platforms like VanEck integrating ETH-based products. However, SharpLink's $14M transfer to OKX ahead of earnings may indicate short-term profit-taking.

Factors Influencing ETH’s Price

Ethereum Rallies Amid Institutional Demand and Short Squeeze

Ethereum surged 4% to retest the $3,468 resistance level, buoyed by institutional inflows and a cascade of short liquidations. Cathie Wood's ARK Invest and JPMorgan expanded their exposure, with BitMine now holding over $11 billion in ETH. The rally triggered $621 million in leveraged trader liquidations, nearly 60% from short positions.

Technical indicators suggest fragility—ETH remains trapped in a mid-term correction despite the rebound. The supply wall at $3,468 poses immediate resistance; failure to breach may reignite bearish momentum. Market sentiment hangs on whether this marks a trend reversal or temporary respite.

Bit Digital Expands Ethereum Holdings to $590.5M Amid Strategic Acquisitions

Bit Digital, Inc. (NASDAQ: BTBT) reported a surge in its Ethereum treasury, reaching $590.5 million by October 2025. The firm acquired 31,057 ETH during the month, reinforcing its dominance in Ethereum staking with 132,480 ETH actively staked.

Ethereum's price appreciation to $3,845.79 per token drove the valuation spike. Bit Digital's average acquisition cost stood at $3,045.14, demonstrating strategic accumulation during market movements. Staking operations yielded 249 ETH in rewards, showcasing the profitability of their validator operations.

Despite the crypto asset growth, BTBT shares declined 4.08% during the period, trading between $2.90-$3.05. The divergence between operational success and stock performance highlights the complex valuation dynamics of crypto-native enterprises.

SharpLink Gaming's Ethereum Transfer Sparks Market Speculation Ahead of Earnings

SharpLink Gaming, Inc. (SBET) shares fell 7.91% to $11.17 following a $14.47 million Ethereum transfer to OKX. The move, involving 4,364 ETH, comes days before the company's Q3 earnings call, raising questions about its financial strategy.

Market observers note the transaction coincides with growing Ethereum holdings in SharpLink's treasury, despite recent volatility. The unaccounted 920 ETH from the total 5,284 ETH withdrawal adds further intrigue to the situation.

While some interpret the transfer as routine portfolio rebalancing, others speculate about potential liquidation plans. The company's Ethereum staking rewards continue to provide a counterbalance to its stock performance.

Ark Invest Bolsters Crypto Position with $9M BitMine Purchase Amid Market Slump

Cathie Wood's Ark Invest has significantly increased its exposure to cryptocurrency-linked assets, acquiring $9 million worth of BitMine (BMNR) shares across three of its flagship ETFs. The move comes despite BitMine's stock plunging nearly 10% on Thursday, extending a 42.5% monthly decline.

The investment was distributed across Ark's Innovation ETF (ARKK), Next Generation Internet ETF (ARKW), and Fintech Innovation ETF (ARKF), with BitMine now representing approximately 2.3-2.4% of each fund's holdings. This strategic accumulation follows BitMine's 769% surge since June when the company initiated its Ethereum treasury strategy.

Market sentiment remains divided as other crypto-related equities including Robinhood and Coinbase mirrored BitMine's downward trajectory. The buying spree signals Ark's continued conviction in digital assets even as short-term volatility persists.

VanEck's Treasury Token VBILL Integrates with Aave Horizon RWA Market

VanEck has linked its tokenized U.S. Treasury fund, VBILL, to Aave's Horizon Real-World Asset (RWA) Market on Ethereum. This integration bridges traditional fixed-income products with blockchain lending systems, allowing institutional users to leverage VBILL as collateral in decentralized finance (DeFi).

The setup enables yield optimization strategies, though it carries liquidation risks if VBILL's returns fall below RLUSD borrowing costs. Chainlink's NAV oracle and Securitize's infrastructure ensure transparent pricing and compliance, marking a significant step in institutional DeFi adoption.

Carlos Domingo, CEO of Securitize, emphasized the milestone on X, noting Horizon's potential to surpass traditional markets in efficiency. The move signals growing convergence between regulated financial instruments and on-chain liquidity pools.

ARK Invest Expands Ethereum Bet with Major BitMine Share Purchase

Cathie Wood's ARK Invest has significantly increased its exposure to Ethereum through a strategic purchase of 240,507 shares in BitMine Immersion, a publicly traded company that treats ETH as a core treasury asset. This move underscores a broader institutional shift toward viewing Ethereum not just as a cryptocurrency but as a financial instrument with long-term utility.

BitMine Immersion distinguishes itself by holding Ethereum on its balance sheet rather than mining and liquidating it immediately. The company's strategy, championed by market strategist Thomas Lee, aligns with ARK Invest's philosophy of identifying disruptive growth early—particularly in sectors challenging traditional finance.

The investment signals confidence in Ethereum's role as a treasury asset, complementing ARK's existing ETF-based bets on crypto. While no direct exchange involvement was noted, the transaction reinforces Ethereum's maturation beyond speculative trading into corporate financial strategy.

SharpLink Transfers $14M in Ethereum to OKX Ahead of Earnings, Raising Concerns

SharpLink Gaming, a Nasdaq-listed company, has moved 4,364 ETH worth approximately $14.47 million to crypto exchange OKX. The transaction, executed on November 7, precedes the firm's third-quarter earnings call, sparking speculation about its motives.

Blockchain analytics platform Lookonchain traced the funds to a SharpLink-linked wallet that initially redeemed 5,284 ETH ($17.52 million). While 791 ETH remains in the wallet, about 920 ETH remains unaccounted for. The transfer coincides with a 37% monthly decline in SharpLink's stock (SBET), which now trades below the value of its crypto holdings.

Ethereum's market performance adds context—the asset has dropped 26% over the past month, slipping below $3,300. SharpLink has historically used share buybacks to stabilize investor sentiment, leaving market watchers to ponder whether this move signals strategic repositioning or distress.

Ethereum Bulls Return as Santiment Flags Sentiment Shift Amid Market Panic

Ethereum traders have abruptly shifted from bearish to bullish sentiment, according to Santiment data, marking the highest optimism since July. The analytics firm noted a 2.7:1 ratio of bullish to bearish social media chatter after ETH rebounded toward $3,500, currently trading at $3,323.

Santiment warns this surge in retail enthusiasm could backfire—historically, crypto markets often move counter to crowd psychology. The firm observed similar FOMO patterns preceding reversals, suggesting caution despite ETH's 24-hour range of $3,251-$3,451.

Ethereum Price Dip Sparks Debate: Accumulation Opportunity or Bear Trap?

Ethereum's 13.6% weekly decline to $3,099 has divided analysts. Michaël van de Poppe of MN Trading Capital sees the $3,337 rebound zone as prime accumulation territory, while pseudonymous trader Ash Crypto warns of a potential 'massive bear trap' ahead of projected Q4 momentum.

Exchange supply contraction adds bullish pressure, with CoinCodex forecasting $3,803 targets by December 2025. The market watches whether this correction mirrors 2023's Q3 dip that preceded a 58% rally.

Ethereum Whales Seize Market Dip with Strategic Investments

Ethereum's price dropped 3.3% to $3,331, breaching the critical $3,400 support level. Despite the downturn, blockchain data reveals whales accumulated 394,682 ETH worth $1.37 billion within the $3,247-$3,515 range, signaling confidence in long-term value.

Trading volume spiked 145% above the 24-hour average during peak selling pressure, suggesting institutional activity dominated the sell-off. Failed resistance tests at $3,350 and a persistent downtrend from the $3,920 peak maintain bearish technical signals.

Will ETH Price Hit 4000?

John from BTCC suggests ETH has a 65% chance to reach $4,000 by year-end, contingent on:

| Factor | Impact |

|---|---|

| MACD Momentum | Bullish crossover supports upside |

| Institutional Demand | Bit Digital/ARK Invest activities fuel buying pressure |

| Bollinger Band Position | Needs to hold above $3,774 middle band |

Key resistance lies at the upper Bollinger Band ($4,286).

Past performance is not indicative of future results.